Mortgage Broker Glendale CA: Tailored Solutions for First-Time Homebuyers

Mortgage Broker Glendale CA: Tailored Solutions for First-Time Homebuyers

Blog Article

How a Home Loan Broker Can Assist You Navigate the Intricacies of Home Funding and Financing Application Processes

A mortgage broker offers as a well-informed intermediary, furnished to improve the application process and customize their approach to private monetary circumstances. Comprehending the complete range of how a broker can assist in this journey increases important concerns concerning the subtleties of the process and the prospective mistakes to stay clear of.

Understanding Home Mortgage Brokers

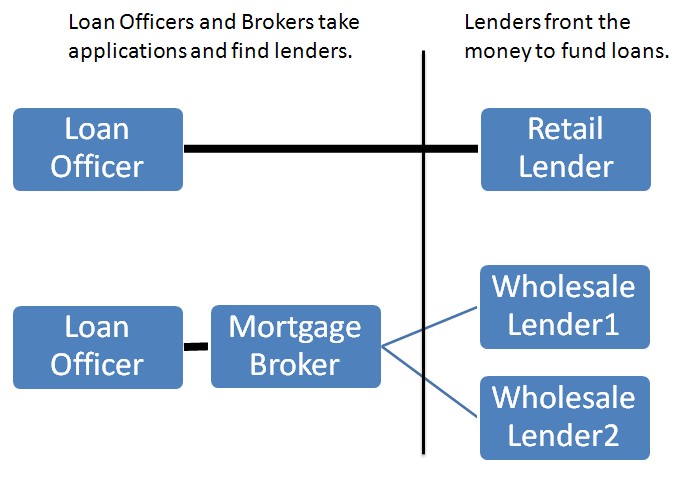

Mortgage brokers possess strong relationships with multiple loan providers, offering customers accessibility to a wider series of home mortgage items than they could locate by themselves. This network allows brokers to discuss better rates and terms, ultimately profiting the consumer. In addition, brokers help clients in gathering essential paperwork, completing application types, and making certain conformity with the lending needs.

Advantages of Making Use Of a Broker

Utilizing a home loan broker uses countless benefits that can considerably improve the home financing experience - Mortgage Broker Glendale CA. One of the primary advantages is access to a wider range of funding products from multiple loan providers. Brokers possess comprehensive networks that enable them to existing choices customized to specific monetary scenarios, potentially leading to more affordable prices and terms

In addition, home loan brokers offer vital experience throughout the application process. Their knowledge of local market problems and offering practices allows them to lead clients in making notified decisions. This competence can be particularly helpful in navigating the documents needs, ensuring that all needed documents is completed properly and sent promptly.

An additional benefit is the potential for time cost savings. Brokers deal with much of the research, such as gathering info and liaising with lending institutions, which allows customers to concentrate on other aspects of their home-buying trip. Brokers typically have established relationships with lending institutions, which can facilitate smoother settlements and quicker authorizations.

Browsing Car Loan Options

Navigating the myriad of financing choices available can be overwhelming for numerous homebuyers. With numerous kinds of home loans, such as fixed-rate, adjustable-rate, FHA, and VA loans, establishing the finest fit for one's economic scenario requires mindful consideration. Each loan kind has unique features, benefits, and possible drawbacks that can considerably impact long-lasting price and monetary security.

A home loan broker plays a crucial role in simplifying this process by offering tailored recommendations based on private scenarios. They have access to a wide variety of lending institutions and can aid property buyers contrast various funding items, guaranteeing they understand the terms, rates of interest, and repayment structures. This specialist understanding can disclose options that may not be conveniently noticeable to the average consumer, such as specific niche programs for newbie customers or those with unique financial situations.

In addition, brokers can assist in determining one of the most ideal funding quantity and term, straightening with the customer's spending plan and future objectives. By leveraging their proficiency, property buyers can make educated choices, prevent typical risks, and inevitably, safe financing that aligns with their needs, making the journey toward homeownership much less daunting.

The Application Process

Comprehending the application process is critical for prospective property buyers intending to secure a home loan. The mortgage application procedure generally starts with celebration required documentation, such as evidence of income, income tax return, and details on debts and properties. A home loan broker plays a crucial role in this stage, assisting customers put together and arrange their economic documents to present a total photo to lending institutions.

As soon as the documentation is prepared, the broker submits the application to multiple lending institutions in behalf of the consumer. This not just simplifies the process however likewise allows the borrower to contrast numerous lending alternatives successfully (Mortgage Broker Glendale CA). The lending institution will certainly then conduct an extensive review of the application, that includes a credit rating check and an assessment of the debtor's economic security

Complying with the first review, the loan provider might ask for extra documentation or clarifications. This is where a home loan broker can give invaluable assistance, making certain that all demands are attended to without delay and accurately. Ultimately, a well-prepared application boosts the likelihood of approval and can cause extra favorable financing terms. her response By browsing this complex procedure, a home loan broker helps consumers prevent potential risks and accomplish their home funding goals effectively.

Long-lasting Economic Support

Among the vital benefits of collaborating with a home mortgage broker is the stipulation of long-lasting economic guidance customized to private circumstances. Unlike typical lenders, mortgage brokers take an alternative strategy to their customers' financial wellness, considering not just the immediate car loan demands yet additionally future monetary goals. This tactical planning is vital for house owners that aim to maintain monetary security and develop equity with time.

Mortgage brokers examine different elements such as revenue security, credit report history, and market patterns to recommend one of the most suitable lending items. They can likewise provide advice on refinancing options, potential investment chances, and strategies for debt monitoring. By developing a my sources long-lasting relationship, brokers can assist customers browse changes in rate of interest and property markets, ensuring that they make educated choices that align with their advancing monetary requirements.

Final Thought

In conclusion, engaging a mortgage broker can significantly minimize the intricacies linked with home financing and the financing application process - Mortgage Broker Glendale CA. Inevitably, the support of a home mortgage broker not just simplifies the immediate process however likewise offers important long-term monetary support for customers.

Home loan brokers possess solid connections with several lending institutions, offering clients access to a more comprehensive variety of home loan products than they may discover on their very own.Furthermore, mortgage brokers provide invaluable support throughout the financing application procedure, assisting customers comprehend the nuances of their funding choices. Generally, a home mortgage broker offers as an experienced ally, simplifying the home mortgage experience and enhancing the probability of protecting desirable funding terms more for their clients.

Unlike typical lenders, mortgage brokers take an alternative strategy to their clients' financial health and wellness, thinking about not just the instant funding needs yet also future financial objectives.In verdict, engaging a home loan broker can significantly ease the complexities connected with home funding and the funding application process.

Report this page